Efficiently distribute the same ETF across multiple markets.

ETFs - Issuers

Euroclear group

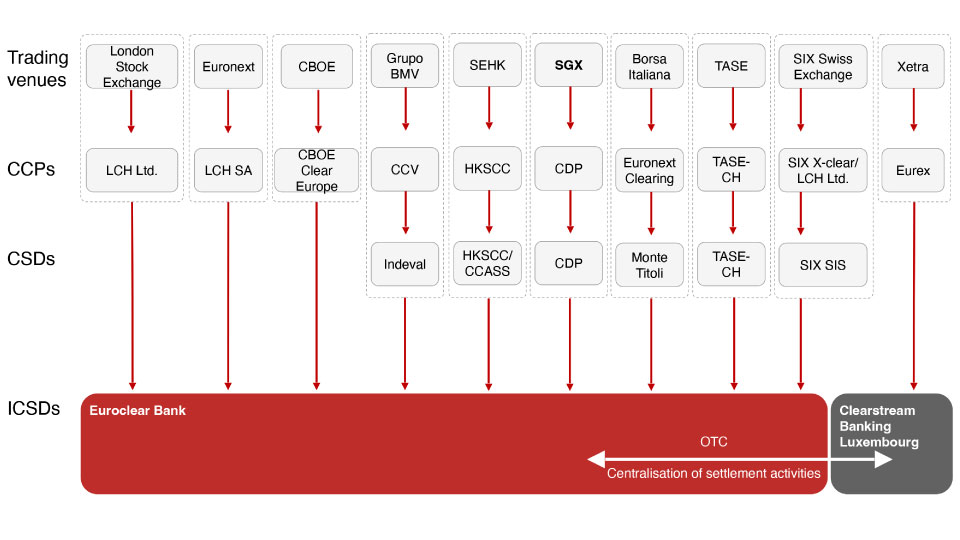

Euroclear Bank allows you to efficiently distribute the same ETF to multiple markets worldwide thanks to its long settlement window. Therefore, you are not restricted to only European markets. To do so, you simply create the prospectus defining the international issuance features and requirements. Based on the prospectus, Euroclear Bank makes the ETF eligible on its platform. On the launch date of the ETF, the Global Share Certificate is held by one of the common depositories used by Euroclear bank.

The multi-currency platform of Euroclear Bank allows you to issue in any of the eligible currencies (currency hedge). Your ETF will enjoy the advantages of a strong ecosystem including all market makers, authorised participants, prime brokers, custodians, stock exchanges, CCPs, CSDs and transfer agents.

Enjoy several key benefits of a single settlement location in Euroclear Bank.

- Centralisation of the liquidity: Because of less fragmentation, the ICSD model decreases the number of complex realignments between CSDs when trading between different stock exchanges. The model also reduces costs and simplifies inventory management. As a consequence, the risk of settlement failure is dramatically brought down and the number of costly buy-ins to cover settlement fails and related CSDR penalties dropped. This results in more competitive spreads.

- Multi-currency settlement: Euroclear’s ICSD model gives you access to settlement in all our eligible currencies.

- All OTC transactions can also settle in Euroclear Bank.

- One single ISIN per ETF: Regardless of market, trading venue or currency, your ETF will be identified by one single ISIN.

- Comprehensive asset servicing: We offer market claims in the base currency, harmonised ex-dates and automatic forex conversions for dividends.

- Transparency: We can provide issuers with a view of the holders in the Euroclear Bank system.

- Proximity: All stakeholders in the ecosystem are connected to Euroclear.