Euroclear’s securities lending and borrowing programme – benefits for lenders

Securities lending

Get the most from your portfolio

If you are looking for new opportunities to earn additional income in a risk-free environment, then Euroclear’s securities lending programme is the right solution for you.

Securities lending is a well-established activity that maximises yield on portfolio. Solid risk management and no extra administration is a must for any lending activity, which is why so many companies select our programme for their securities lending activity.

Euroclear’s securities lending and borrowing programme has been an integral part of our settlement service for more than three decades. Unlike many street lending desks that focus on demand from trading or arbitrage strategies, our securities lending targets borrowing demand to avoid settlement fails.

The programme takes place in one of the safest financial environments in the world. Whenever a settlement fail is detected due to a lack of securities, the programme automatically provides the securities from a large anonymous lendable pool provided by international market players.

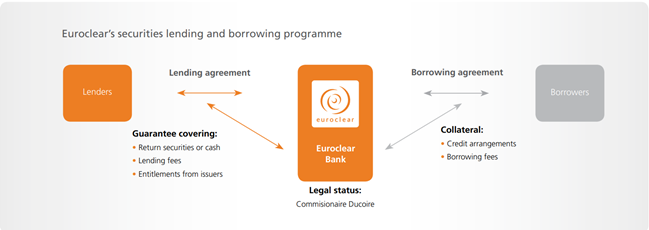

- No direct relationship between lenders and borrowers. Instead, participants have a contractual relationship with Euroclear, which takes the exposure risk.

- Complete confidentiality. The name and positions of the counterparties are not disclosed. Lenders’ positions are aggregated into an anonymous ‘lending pool’ from which securities are allocated to borrowers.

- Flexibility to tailor your participation. Meet your needs by using service options which can be modified at any time.

The securities lending programme is a well-established fail-driven service that has been fully integrated into Euroclear’s settlement system for more than three decades.

With just one contract, you can gain access to a large pool of carefully selected borrowers and earn additional revenues on portfolios in a very safe environment.

As a lender, you can earn returns on your portfolio by lending a wide range of securities to the most active international counterparties.

You retain full ownership benefits and enjoy automatic compensation for entitlements such as income and redemption payments on lent securities.

You do not need to send loan instructions or agree on contracts with individual borrowers. Euroclear takes care of everything from loan generation through to asset servicing and administration.

You can lend your securities to borrowers with confidence in the knowledge they are subject to Euroclear’s strict credit policy. Should the borrower be unable to reimburse your securities, Euroclear guarantees their return (or their cash equivalent).

If you need your loaned securities back to settle pending trades, the system will automatically substitute you with another lender if available.

The programme allows you to define your profile and stay in control. For example, you can select the securities you want to lend, and set limits on how much you want to lend on your account.

- Earn attractive revenues through automated loans

- No additional workload: the daily administrative and operational burdens are undertaken by Euroclear

- The Euroclear guarantee covers the return of your securities (or their cash equivalent) if a borrower does not return securities in time or becomes insolvent

- There is no reinvestment risk, as no cash collateral is involved

- No safekeeping fees are charged on your lent positions

Euroclear has invested heavily over the years in the resilience of its risk management procedures and systems, which have proved themselves robust in times of crisis.

The Euroclear guarantee enters into effect immediately when your securities are lent. It covers the market value of lent assets, which is reassessed on a daily basis, as well as entitlements and the payment of lending fees.

Lender indemnification covers recall situations, where the borrower does not return securities in time, and bankruptcy situations.

In both cases, Euroclear will return the lent securities to the lender, provided securities can be obtained in the market, or will compensate the lender with a cash equivalent.

As a lender, you do not receive any collateral from the borrower; your exposure is with Euroclear Bank. There is therefore no reinvestment risk.

Euroclear is strong and stable and has been consistently rated AA by Fitch Ratings and by Standard & Poor’s. We are renowned for applying a conservative participant admission and credit policy.

Borrowers are carefully selected and are subject to credit arrangements with Euroclear. This credit facility covers the borrower’s obligation to return the securities; and is granted based on an in-depth analysis and review of the borrower’s activity in Euroclear.

A borrower must hold enough collateral in his pledged Euroclear securities clearance accounts and cash accounts to cover the market value of borrowed securities. Collateral is made available to Euroclear Bank on a simultaneous and irrevocable basis when securities are transferred to the borrower’s account.

Euroclear has established a reputation as an industry leader in collateral valuation techniques. We re-value securities loans daily and any additional collateral required is automatically selected from the borrower’s account and posted when needed. Haircuts are applied to the collateral as a function of the quality of the collateral.