Reference data is responsible for a large proportion of data used in financial transactions each day, making it vital that financial organisations have the most accurate and up-to-date information available to them.

Reference Data

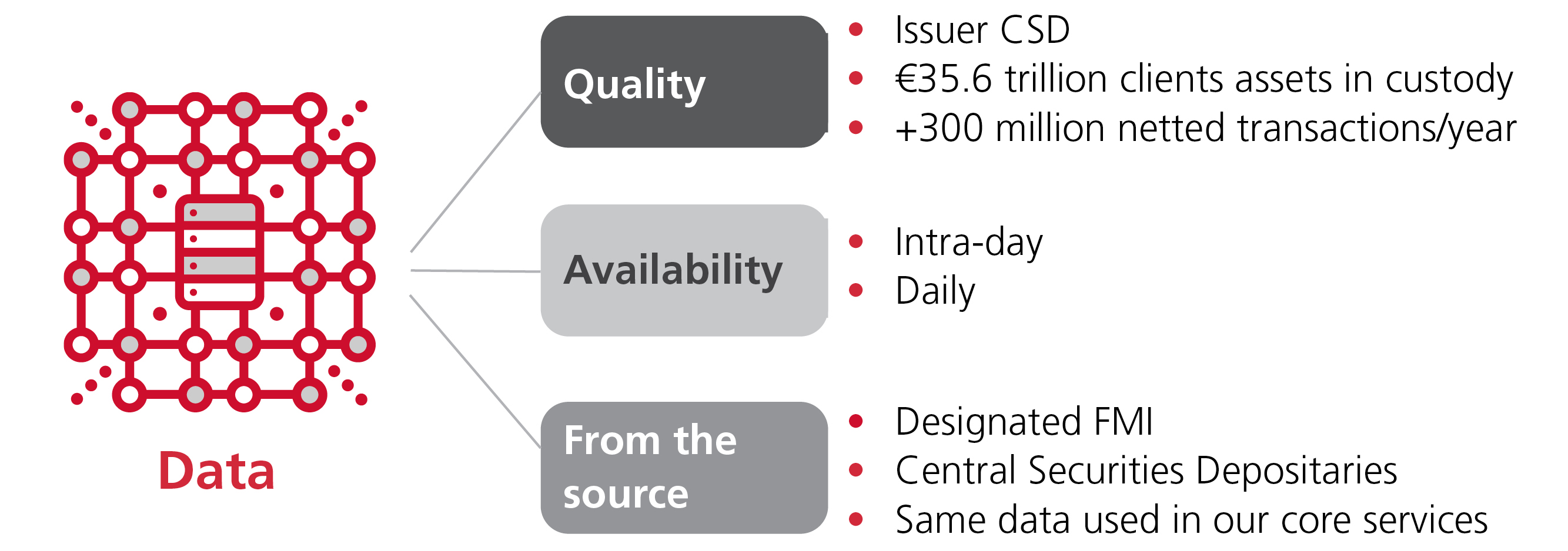

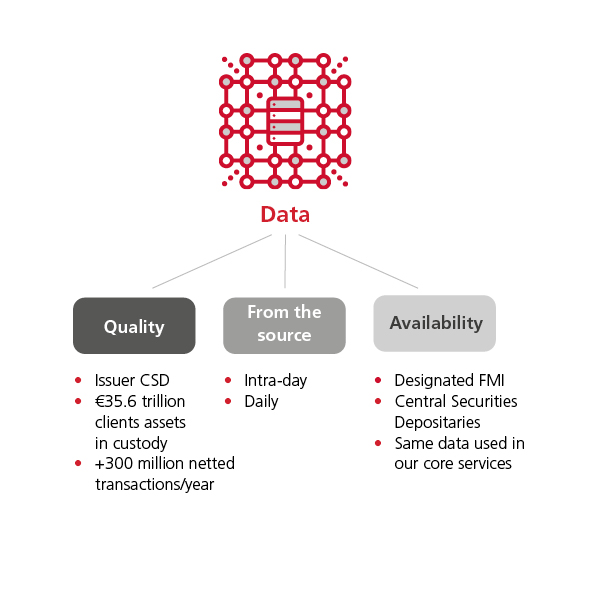

Euroclear Reference Data is high-quality and timely reference data sourced from Euroclear group FMIs. Whether it is used for settlement, valuations, corporate actions processing, risk management or regulatory reporting, it can help you overcome data challenges across your enterprise by feeding data to applications from front-, middle- to back-office applications. This is the same data that we use in our core businesses and what you can also use to ensure consistency and accuracy of data across your firm.

As a trusted global provider of post-trade services, we provide:

- highly reliable Reference Data

- timely and accurate corporate actions information

- real-time feed of high quality new issues information

The Euroclear group is made up of Euroclear Bank, Euroclear Belgium, Euroclear France, Euroclear Nederland, Euroclear Finland, Euroclear Sweden and Euroclear UK & International.

- Primary data set: a daily feed of all securities eligible in a given CSD for settlement and custody

- Key attributes to identify securities, their holding structure and authorized settlement operations

- Containing securities eligible in Euroclear Bank, ESES or Euroclear UK & International

- Extended data set: a more granular data set on securities with Euroclear as issuer CSD

- Comprehensive reference data extracted from legal documentations to effectively service the security

- Currently available for Eurobonds, French, Dutch and Belgian domestic securities

- Fast intra-day corporate actions notifications on all outstanding Eurobonds, Belgian, Dutch, French, Irish and UK securities

- Covering a whole suite of event types, including scheduled/unexpected and mandatory/voluntary events

- Complete and accurate information on key reference attributes from the primary source

- Delivered via MFT (.txt file) in Swift ISO 15022 format, allowing you to automate the capture of corporate actions

To find out more about Reference Data, contact your Relationship Manager or email us at eis@euroclear.com