Euroclear Bank has signed an agreement with the European Central Bank (ECB) and the central banks of the euro area to join ECB’s TARGET2-Securities (T2S) settlement system.

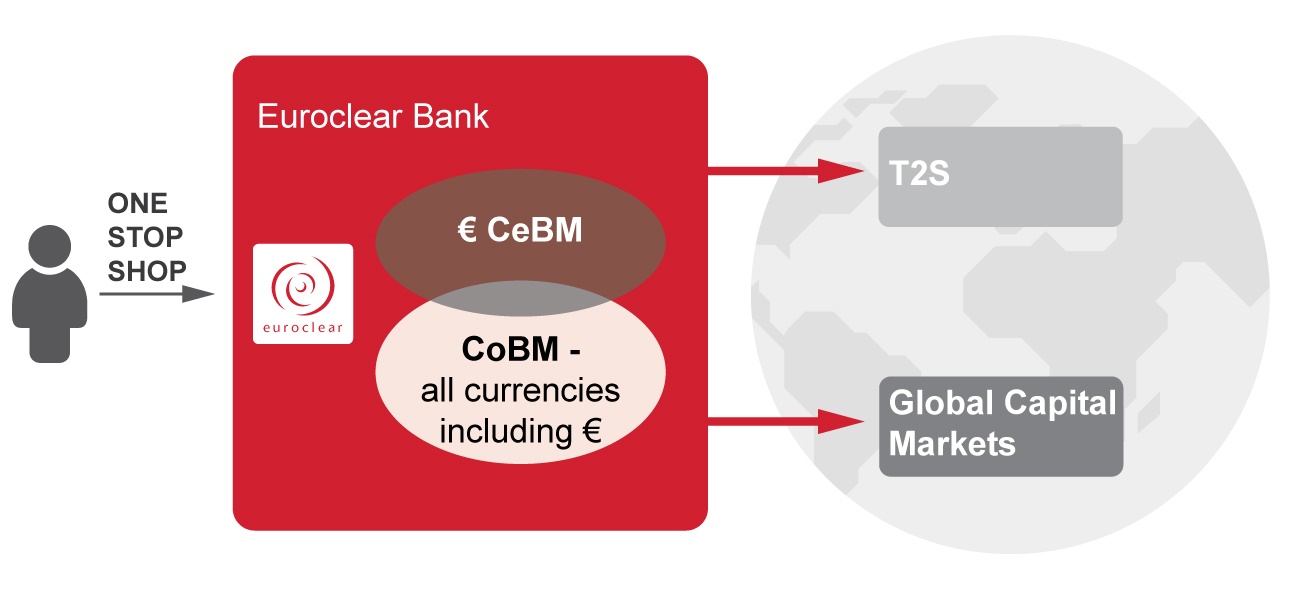

Euroclear Bank as an open Financial Market Infrastructure is where the pan-European and Global markets intersect. By providing a seamless access to Central Bank Money (CeBM) and Commercial Bank Money (CoBM) in EUR, Euroclear Bank will allow its clients to consolidate all their EUR liquidity in one location.

Euroclear Bank joining T2S will:

- make it easier for EU companies to access reliable and efficient sources of funding

- enable a broad range of securities to be eligible for settlement on T2S, translating into real flexibility in the choice of central bank money and commercial bank money for Euro Settlement

- increase European market resilience by reducing the overall settlement risk through

- the central bank guarantee on settlement payment obligation

- a centralised access to a large pool of international securities, to support settlement liquidity on T2S

- a wide range of secured sources of funding, including central bank credit operations