In November 2024, the new Eurosystem Collateral Management System (ECMS) will change the way you interact with central banks to post collateral and receive credit. Euroclear clients will be able to benefit from this new initiative without having to implement significant changes to their current operational setup.

Accessing central bank liquidity in Euroclear France

Changes and opportunities post ECMS

Euroclear France clients can keep things simple and continue to benefit from seamless access to central bank liquidity.

While settlement will take place in T2S, you can continue to operate your account with us as you do today; we will deliver collateral to the NCBs in T2S on your behalf - eliminating the need to implement costly and complex operational changes.

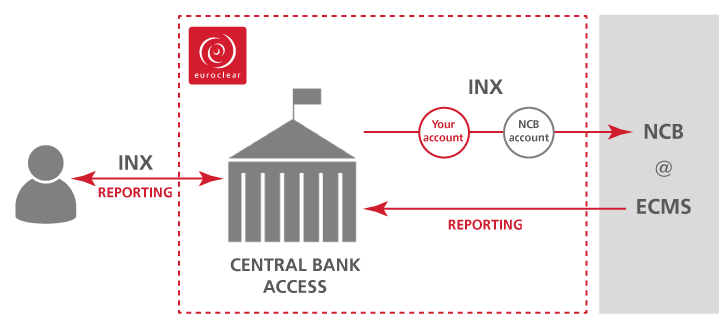

Our new Central Bank Access service does away with the need for you to send instructions to both the CSD and ECMS. You can outsource the management of all aspects of bilateral settlement with NCBs - giving you new opportunities to:

- streamline your operations with straight-through processing

- increase end-to-end efficiency in the mobilisation and demobilisation of collateral with NCBs

You can also benefit from triparty-like functionalities while we take care of the bilateral-settlement processes of the NCBs.

For the mobilisation of collateral, simply send your instruction to us – as you do today – either using MT527 or EasyWay. We:

- select collateral on your account and deliver it to your central bank

- send the necessary mobilisation requests for ECMS to accept delivery of the collateral

- provide you with consolidated reporting

- collateral management reporting through the MT569 or the Margin Report

- substitutions performed automatically in an event such as an asset being required to meet your settlement obligations or no longer being ESCB eligible

- easily adjust the amount of collateral you post to the NCB