Fund management companies want to grow their assets under management by attracting new investment to their existing funds and opening new successful funds.

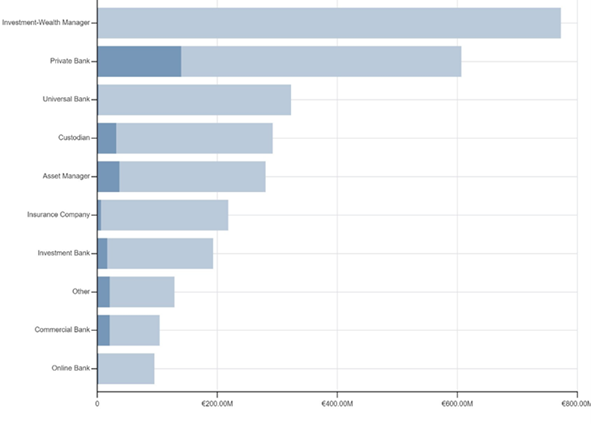

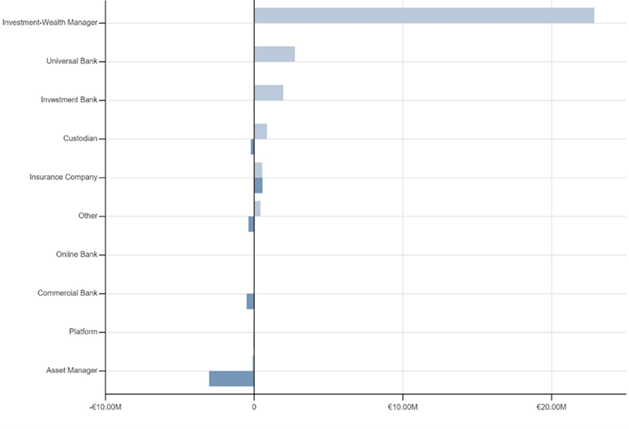

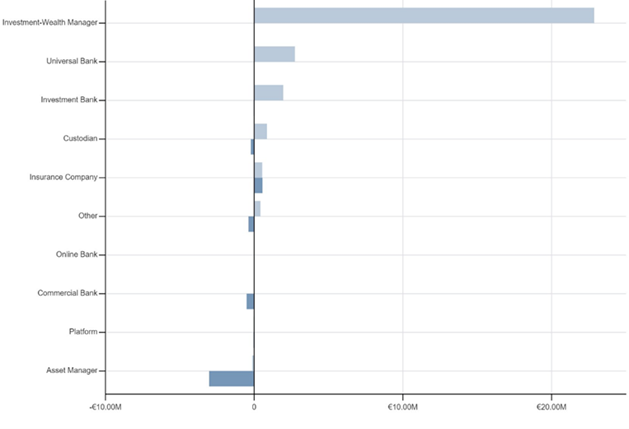

To do this, understanding investor behaviour is key – by identifying market trends through positions and flows data, fund management companies can identify which markets they should be present in and which investors they should be selling to. In this article, we run through an example of a fund management company that wants to grow their assets in their retail fixed income fund, using analysis from our new market intelligence tool.